See if Settle Working Capital is right for your CPG brand

It's financing tailored to the way CPG and e-commerce brands work. Schedule a demo with our team to learn more about eligibility, terms, and pricing. Eligible for U.S. incorporated e-commerce businesses that make over $300k in yearly revenue.*

-

Founder centric capital that's equity free and not revenue based

-

Leverage funds for inventory, raw goods, packaging, and marketing costs

-

Customers experience an average 1 year gross revenue growth of 385%**

**Calculated based on 188 customers' average rate of increase for gross revenue YoY one year after activating on Settle.

We were able to launch more products because we had access to this capital and we were actually able to do all of this without raising additional capital.

Nish Samantray | Co-Founder

Settle is a lifeline for the CPG world because cash is tight.

Sarah Rioux | Co-Founder

Book Your Financial Consultation

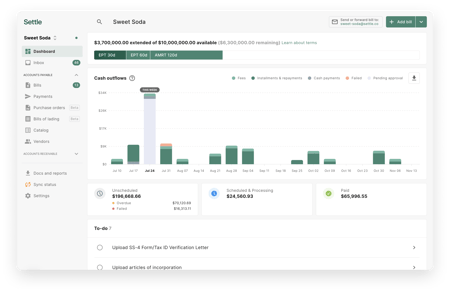

Smart financing that drives your business growth

Flexible funding

Use only what you need, so you don't end up borrowing more money than necessary.

Non-dilutive capital

Settle allows you to purchase what you need without giving away ownership.

Fixed rate financing

Unlike revenue based financing, our rates are fixed so you can retain more of your revenue.

Comprehensive solutions to meet your every need

Transparent terms

Holistic underwriting

Flexible repayment

Finance beyond inventory

Who do we work with?

Settle Working Capital is designed for businesses that meet these key criteria*, ensuring we provide the right support for your growth.

-

You are a CPG or e-commerce business operating out of the United States

-

Your business has been operating for at least 1 year

-

Your business drove over $300k in revenue in the last 12 months

How it works

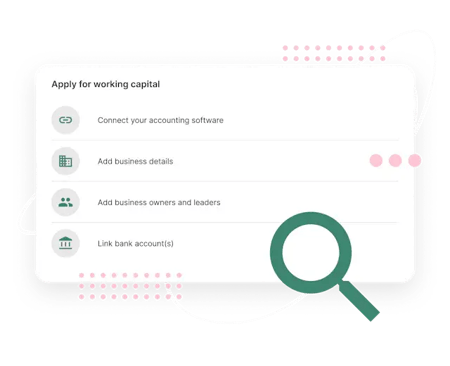

1. Apply

Sync your financial software with our easy integration and get your credit eligibility in as little as 1–3 business days.

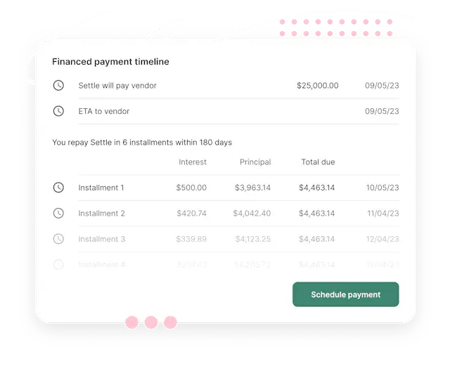

2. Finance

Upload a bill, then choose your preferred currency, payment method, and schedule. We’ll pay the vendor on your behalf.

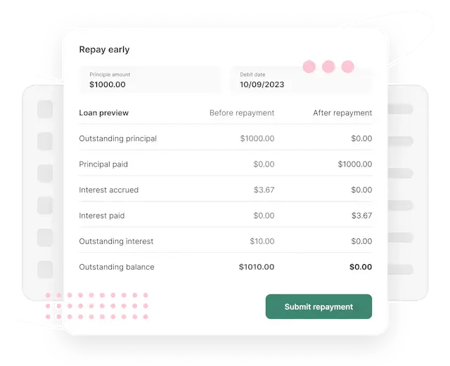

3. Repay

Pay us back 30–180** days later with our fixed repayment schedule.

**Actual terms depend on an individual business’s credit eligibility.

4. Grow

We’ll regularly assess your credit eligibility to ensure it aligns with your business so you can take your brand to the next level.